Why Filing an Online Tax Return in Australia Is the Fastest Way to Obtain Your Refund

Simplify Your Financial resources: How to Submit Your Online Income Tax Return in Australia

If approached methodically,Filing your on the internet tax obligation return in Australia need not be a challenging job. Recognizing the complexities of the tax obligation system and effectively preparing your documents are vital initial steps. Selecting a reputable online platform can improve the process, however many neglect essential information that can influence their total experience. This conversation will certainly discover the required elements and approaches for streamlining your funds, inevitably leading to a much more effective declaring procedure. What are the typical risks to prevent, and just how can you ensure that your return is certified and exact?

Understanding the Tax System

To browse the Australian tax obligation system efficiently, it is important to understand its fundamental principles and structure. The Australian tax obligation system runs on a self-assessment basis, implying taxpayers are accountable for accurately reporting their income and calculating their tax obligation responsibilities. The main tax obligation authority, the Australian Taxes Workplace (ATO), manages compliance and applies tax obligation laws.

The tax obligation system comprises various elements, consisting of earnings tax obligation, goods and solutions tax (GST), and resources gains tax obligation (CGT), to name a few. Specific income tax obligation is modern, with rates boosting as income surges, while company tax obligation rates vary for small and huge companies. In addition, tax offsets and reductions are offered to lower gross income, allowing for even more customized tax responsibilities based on personal scenarios.

Understanding tax residency is additionally important, as it determines a person's tax responsibilities. Residents are tired on their worldwide income, while non-residents are only taxed on Australian-sourced income. Familiarity with these principles will empower taxpayers to make educated choices, making certain conformity and potentially optimizing their tax obligation outcomes as they prepare to submit their on the internet income tax return.

Preparing Your Files

Gathering the required papers is a vital action in preparing to submit your online tax return in Australia. Correct documents not just simplifies the declaring process yet likewise guarantees precision, minimizing the danger of errors that might result in delays or penalties.

Begin by accumulating your income declarations, such as your PAYG payment recaps from companies, which detail your profits and tax kept. online tax return in Australia. If you are self-employed, ensure you have your company income records and any kind of appropriate billings. In addition, gather bank statements and paperwork for any interest gained

Following, assemble documents of insurance deductible expenditures. This might include receipts for job-related costs, such as uniforms, travel, and devices, in addition to any type of academic costs connected to your profession. Ensure you have documents for rental earnings and associated expenditures like repair services or home management costs. if you have home.

Do not fail to remember to consist of other pertinent files, such as your wellness insurance coverage details, superannuation payments, and any financial investment earnings declarations. By carefully arranging these files, you establish a solid structure for a smooth and efficient on the internet tax obligation return process.

Choosing an Online System

After arranging your documentation, the following action includes picking an ideal online system for filing your income tax return. online tax return in Australia. In Australia, numerous credible platforms are available, each offering special features customized to various taxpayer needs

When selecting an online system, think about the interface and ease of navigating. An uncomplicated design can significantly boost your experience, making it simpler to input your details precisely. In addition, ensure the platform is compliant with the Australian Tax Workplace (ATO) regulations, as this will ensure that your entry satisfies all legal needs.

Platforms offering live chat, phone support, or extensive FAQs can provide valuable aid if you run into obstacles throughout the declaring process. Look for platforms that make use of security and have a strong personal privacy policy.

Lastly, consider the costs linked with different platforms. While some might supply cost-free solutions for basic tax returns, others might charge fees for advanced features or added support. Consider these aspects to choose the platform that aligns ideal with your monetary situation and declaring needs.

Step-by-Step Declaring Procedure

The step-by-step filing procedure for your on the internet tax obligation return in Australia is created to improve the submission of your financial details while guaranteeing conformity with ATO guidelines. Begin by collecting all needed documents, including your revenue statements, financial institution statements, and any kind of invoices for deductions.

When you have your documents prepared, visit to your selected online system and produce or access your account. Input your individual details, including your Tax obligation File Number (TFN) and get in touch with information. Following, enter your earnings details properly, ensuring to consist of all income sources such as incomes, rental revenue, or financial investment revenues.

After outlining your revenue, proceed to assert qualified reductions. This may include work-related expenditures, philanthropic contributions, and clinical expenses. Make certain to assess the ATO guidelines to optimize your insurance claims.

When all details is gotten in, thoroughly evaluate your return for accuracy, remedying any kind of inconsistencies. After ensuring click here to read every little thing is proper, submit your tax return digitally. You will certainly get a confirmation of entry; keep this for your records. Monitor your account for any kind of updates from the ATO concerning your tax return status.

Tips for a Smooth Experience

Completing your on the internet income tax return can be a straightforward procedure with the right prep work and attitude. To make sure a smooth experience, begin by gathering all required files, such as your earnings declarations, receipts for reductions, and any various other pertinent financial records. This company conserves and minimizes errors time throughout the filing process.

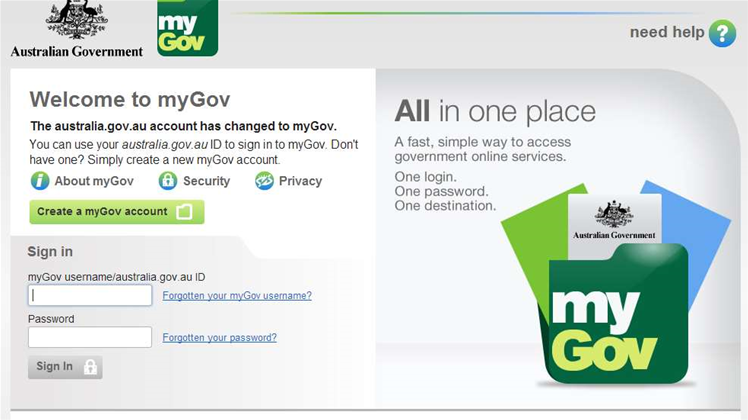

Following, acquaint on your own with the Australian Tax Workplace (ATO) web site and its on-line services. Utilize the ATO's sources, including overviews and Frequently asked questions, to clear up any type of unpredictabilities prior to you start. online tax return in Australia. Consider setting up a MyGov account connected to the ATO for a structured filing experience

Furthermore, benefit from the pre-fill capability supplied by the ATO, which immediately occupies some of your information, reducing the opportunity of mistakes. Guarantee you confirm all access for precision before submission.

If problems occur, don't think twice to consult a tax specialist or utilize the ATO's support services. Following these suggestions can lead to a successful and hassle-free on-line tax return experience.

Verdict

In conclusion, filing an online tax obligation return in Australia can be structured via cautious prep work and choice of appropriate sources. Inevitably, these techniques add to an extra reliable tax filing experience, streamlining financial administration and enhancing compliance with tax obligation responsibilities.